Simplify your clients' workflows with a platform built for scale, flexibility and streamlined financial management.

Manage your international receivables and payables in one unified dashboard

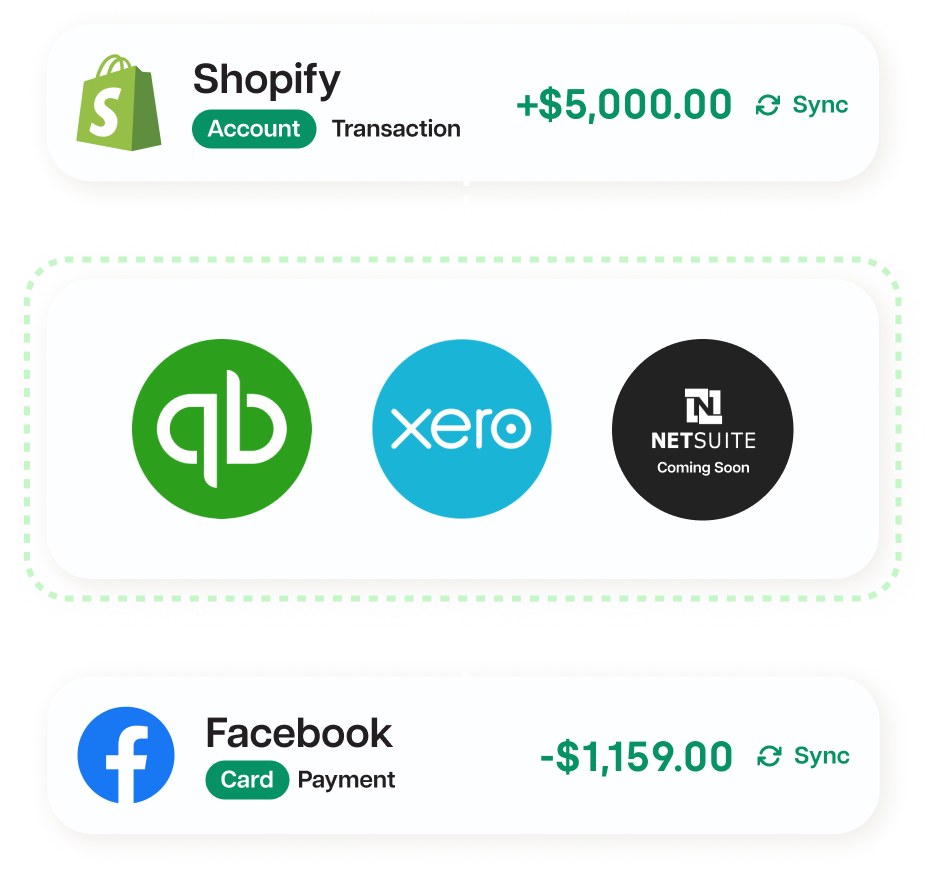

Reconciliation completed in mere minutes with direct transaction pushes to Quickbooks and Xero. (Netsuite coming soon)

Set approval policies on all of your payments and transactions, ensuring tight yet flexible accounting controls

Your team members can use their mobile device and upload receipts via SMS directly to Loop - flowing your records from purchase through to reconciliation

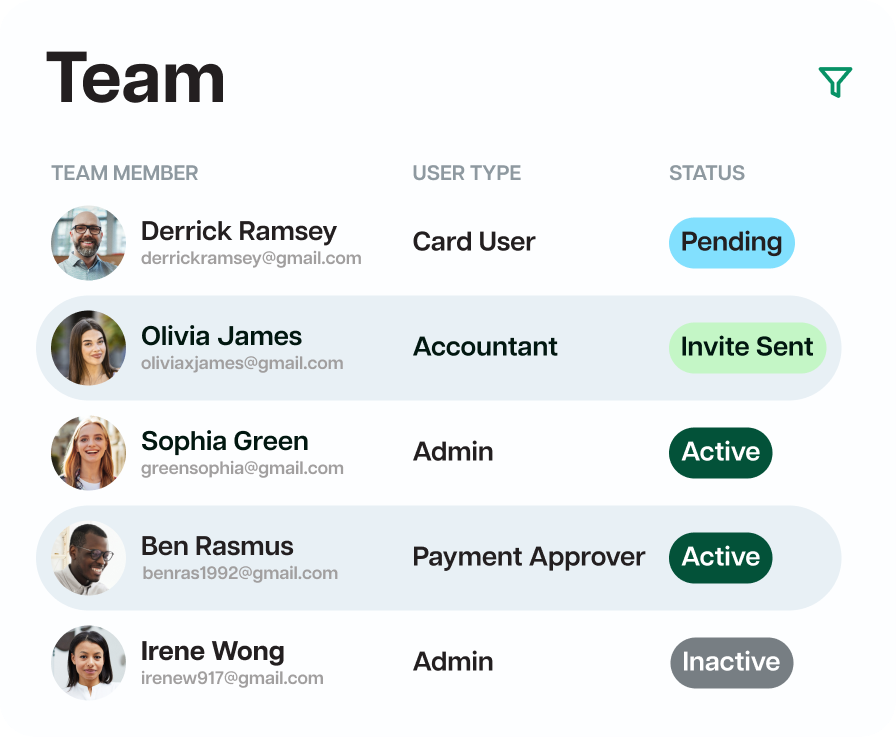

Create customized permissions for each member of your team - ensuring each person has the appropriate permissions and visibility

Contact us to learn how you can access FX rates typically reserved for only Fortune 500 companies

Hear it from the hundreds of clients who use Loop to grow their business

The Loop US bank account is completely life changing for my business. In a year, we will benefit from about $50k in gains straight to our bottom line. So a really big thank you for coming out with this product.

.png)

Our business was looking for working capital when we discovered Loop. Getting the capital we needed was simple, fast and a big game changer for us. We've seen immediately results and continue to partner with Loop.

.png)

If you're a Canadian ecommerce merchant, you should get a Loop card. They have fixed all our cash flow issues, FX costs and issues with paying suppliers around the world. Saving us lots of money and headaches. Plus their team is great!

.png)

Loop offers multi-currency cards that are not locked into just spending with one currency. You can spend in CAD, USD, EUR and GBP with your Loop card, without incurring FX fees on your purchases. Your balances owing are displayed per currency, and can be settled per currency as well. Because your Loop Card allows you to pay back in the currency you spent in, you won’t have to perform any unwanted currency conversions.

You will be able to see multiple balances outstanding on your Loop dashboard (one for each currency). If you have Canadian-based foreign currency accounts (eg. a USD at a Canadian bank), you can then transfer against the outstanding balance of each currency directly from your bank account to your Loop Card balance at the end of your billing period.

If you only have a CAD bank account, you can still make purchases in foreign currencies without the card converting it to CAD. At the end of your billing period, you can then decide to convert money from your CAD account into the currencies you owe. If you need to do this, Loop offers global FX conversion with a 0.5% mark-up. This is significantly less than a bank, which charges a 3-4% markup on average and it’s even better than online FX service providers like Transferwise and OFX.

We have eliminated as many fees as possible to keep things as simple as possible for you. Card transactions that match any of the currencies enabled on your card don’t result in any FX and therefore are completely free. If you spend in a currency that is not enabled on your Loop card the FX fee will be the Mastercard® rate plus a 0.1% - 0.5% markup depending on your Loop subscription plan.

If you only have a CAD bank account, you can still make purchases in foreign currencies without the card converting it to CAD. At the end of your billing period, you can decide to convert money from your CAD account into the currencies you owe. If you need to do this, Loop offers low-cost FX conversion with only a 0.1% - 0.5% mark-up (depending on your Loop subscription plan). Most banks charge a 3-4% markup on average.

In most cases, Loop's FX rates are even better than online FX service providers like Transferwise and OFX. When you need to exchange currencies, doing your FX through your Loop Card significantly saves businesses both time and money.

Free users will get up to 20 virtual cards and up to 2 physical cards. Loop Plus and Power users will get unlimited virtual cards and up to 10 physical cards. Loop Cards should be used only for their intended purposes, such as making online purchases, paying bills, paying for advertising or managing subscription services. If you have any questions about our fair use policy or any other limitations on virtual card creation on our platform, please contact our customer support for further assistance.