Move money around the world with a platform built for scale, volume and compliance.

Manage your international receivables and payables in one unified dashboard

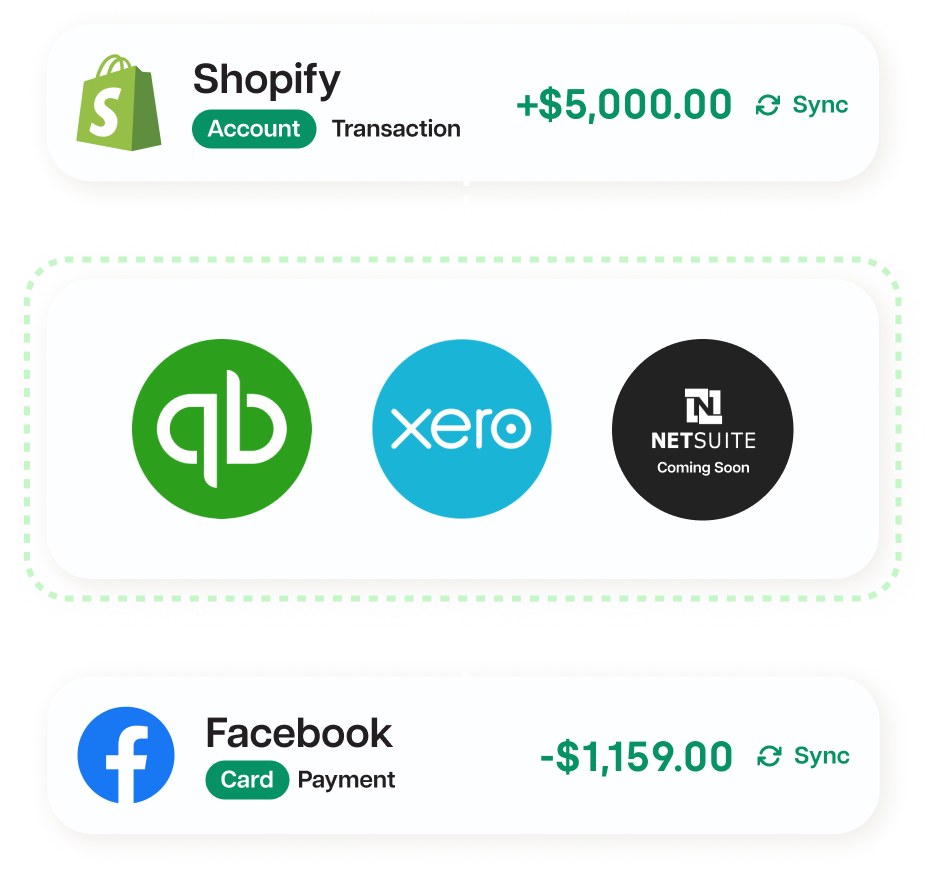

Reconciliation completed in mere minutes with direct transaction pushes to Quickbooks and Xero. (Netsuite coming soon)

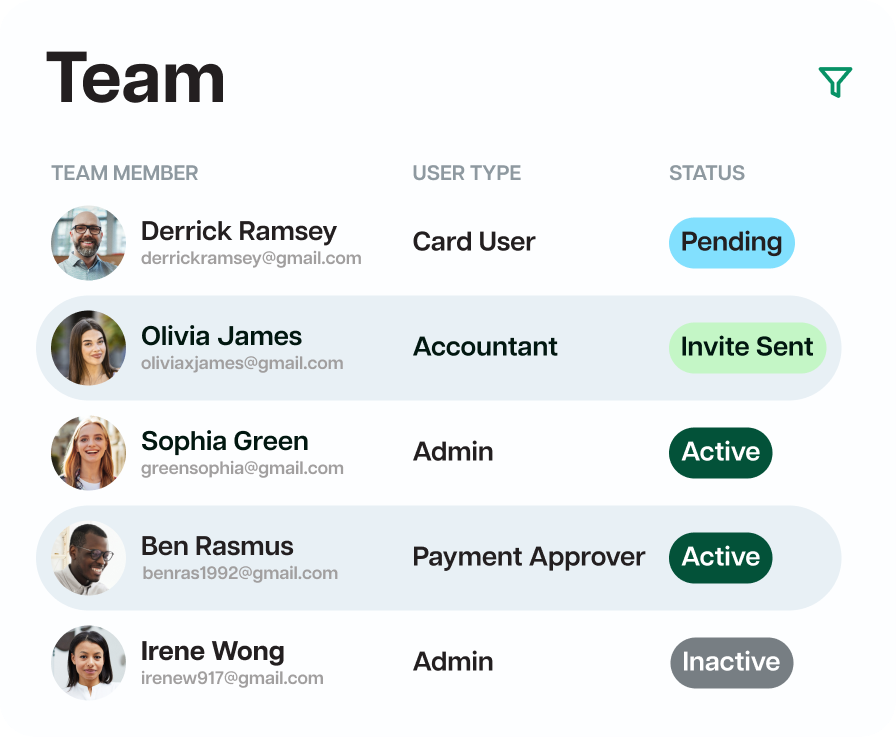

Set approval policies on all of your payments and transactions, ensuring tight yet flexible accounting controls

Your team members can use their mobile device and upload receipts via SMS directly to Loop - flowing your records from purchase through to reconciliation

Create customized permissions for each member of your team - ensuring each person has the appropriate permissions and visibility

Contact us to learn how you can access FX rates typically reserved for only Fortune 500 companies

Hear it from the hundreds of clients who use Loop to grow their business

The Loop US bank account is completely life changing for my business. In a year, we will benefit from about $50k in gains straight to our bottom line. So a really big thank you for coming out with this product.”

.png)

Our business was looking for working capital when we discovered Loop. Getting the capital we needed was simple, fast and a big game changer for us. We've seen immediately results and continue to partner with Loop.

.png)

If you're a Canadian ecommerce merchant, you should get a Loop card. They have fixed all our cash flow issues, FX costs and issues with paying suppliers around the world. Saving us lots of money and headaches. Plus their team is great!

.png)

Loop offers multi-currency cards that are not locked into just spending with one currency. You can spend in CAD, USD, EUR and GBP with your Loop card, without incurring FX fees on your purchases. Your balances owing are displayed per currency, and can be settled per currency as well. Because your Loop Card allows you to pay back in the currency you spent in, you won’t have to perform any unwanted currency conversions.

If you only have a CAD bank account, you can still make purchases in foreign currencies without the card converting it to CAD. At the end of your billing period, you can then decide to convert money from your CAD account into the currencies you owe. If you need to do this, Loop offers global FX conversion with a 0.5% mark-up. This is significantly less than a bank, which charges a 3-4% markup on average and it’s even better than online FX service providers like Transferwise and OFX.

Opening a multi-currency account with Loop is completely free. Additionally, the sign up is completed entirely online - yes you heard that right, you can open U.S., European and U.K. Pound accounts from your couch at home (no more driving across the border to a bank branch). These accounts come with local account and routing numbers that can be used to receive, send, and store funds.

There are no set limits to on the amount of funds you can receive into your multi-currency accounts.

Yes, you can make payments through Loop for free.

We may add a small wire transfer fee in the future to cover the cost we incur to process wires but for now everything is provided at zero cost!

Transfers made through Loop will arrive in your payee’s bank account within 1 business day.

There are no annual fees. Currently, we offer a free monthly plan, Loop Basic. Additional features are available through our Loop Plus plan for $49 CAD/month and $199 CAD/month for the Loop Power plan.